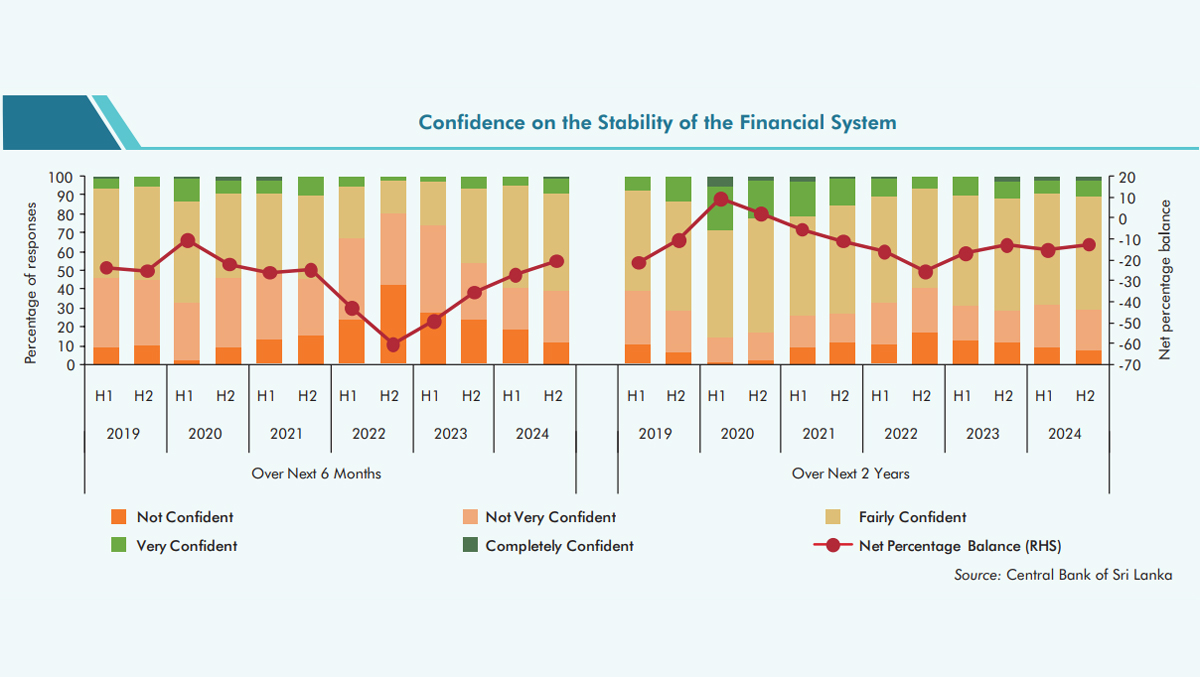

Confidence in Sri Lanka’s banking system has started to improve steadily after plunging in 2022, according to a survey conducted among respondents in banking, insurance, finance companies, stock brokering and unit trusts.

The Systemic Risk Survey (SRS) has been conducted every six months by the Central Bank since 2017 has shown an improvement in perceptions.

“As a result, a substantial proportion of respondents expressed ‘fairly confident’ or better outlook reflecting their improved confidence towards financial system stability,” a Financial Stability Review by the central bank said.

“Although the net percentage balance increased, it remained in the negative territory.”

The net percentage balance is calculated by weighing 1 for ‘completely confident’, 0.5 for ‘very confident’, 0 for ‘fairly confident’, -0.5 for ‘not very confident’ and -1 for ‘not confident’ responses.

Respondents saying ‘not very confident’ about the financial stability has grown steadily over 2021 and 2022 and peaked in the second half of 2022.

Perception of a ‘high impact event materializing in the financial system’ had similarly risen and is now improving.

“The successful completion of domestic debt restructuring and improved macrofinancial conditions in the country may have supported the improvement in market sentiments over the declined probability of high impact event affecting the stability of the financial system,” the report said.

Sri Lanka’s banking system experienced increasingly worse forex shortages as the economy started to recover from a Coronavirus crisis and money printed by the central bank through various liquidity tools to cut rates, was used up as private credit picked up.

At the beginning of 2021 with excess liquidity peaked around 248 billion rupees. At the height of the crisis, banks were unable to pay letters of credit and there were delays in settling interbank forex swaps, analysts who were watching the situation say.

A shift of dollar and also rupee deposits was starting towards foreign banks in particular, when the current central bank Governor Nandalal Weerasinghe allowed interest rates to go up, to match risk and credit demand, analysts say.

Interbank lending was sharply reduced as market participants reduced risk limits for both clean and gilt-backed transactions.

Interest rates rose further as a risk of domestic debt restructuring (an induced default made to meet IMF gross financing need statistics).

Meanwhile the risk survey had indicated that the perceived probability of negative high impact events reduced in 2024, continuing the declining momentum gained in 2023.

“Furthermore, respondents cited improved sentiments on the ability of financial system to withstand high impact events,” the report said.

While confidence improved, domestic macroeconomic risks, risks related to financial institutions, and general risks continued to be lingering key concerns, possibly shaping risk management strategies of respondents.